|

Sector NewswireTM Sector: Mining - Metals and Minerals, Technology :

News Release - February 14, 2017 12:20 PM ET

Gold producer Metanor nets $2M income in last quarter, continues to intersect high-grades, and advances toward opening 2nd mine with PEA all-in costs of US$891/oz.

NEW YORK, NY, February 14, 2017 /Sector Newswire/ - Metanor Resources Inc. (TSX-V: MTO) (US Listing: MEAOF) (Frankfurt: M3R) is a successful commercial junior gold producer at its 100%-owned Bachelor Gold Mill in stable, mining-friendly, Quebec. Metanor is the subject of a Mining MarketWatch Journal review. These are exciting times at Metanor and considering all the Company has to offer and has planned, shares definitely appear worth accumulating at its current trading price; its market cap near-$30 million (trading ~7 cents/share) could easily double in short order. The Company has been producing gold since 2008, originally with the Barry open-pit, then migrating to the Bachelor underground. Metanor is now working towards taking Barry open-pit back online (MTO has PEA on Barry in hand with all-in costs of US$891/oz) and having two sources of ore coming into its Bachelor Mill. Having two mine ore sources will give the Company flexibility and further de-risk the company for shareholders. Metanor has a lot in its favor now; 1) it has the assets (100%-owned 1,200TPD mill and infrastructure has a replacement value in excess of $150 million Canadian), 2) it generates decent positive cash flow from gold production, 3) it is experienced and knows what to expect, 4) it is highly proficient at construction and development, 5) it has exceptional exploration potential, 6) the Company is no longer hamstrung obligation-wise anymore by loans to the Quebec government (having repaid them entirely), 7) and having satisfied its cash flow guarantee it is no longer obligated to process Bachelor ore for Sandstorm (Barry ore is exempt from the streaming agreement).

Full copy of the Mining MarketWatch Journal Review may be viewed at http://miningmarketwatch.net/mto.htm online.

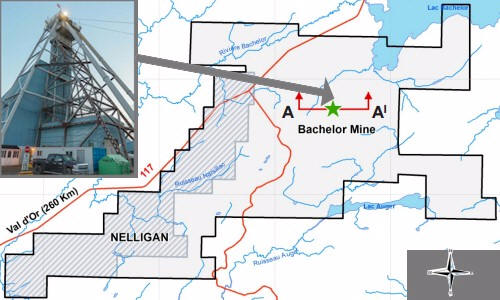

Fig. 1 (below) Primary asset: 100%-owned Bachelor Gold Mill

Gold production -- Metanor firing on all cylinders:

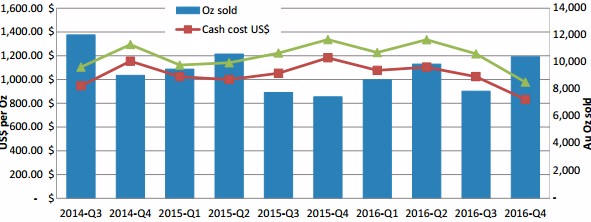

Gold recovery rates at the mill are between 96% to 97% using Carbon in Pulp, and the Company's guidance for this year is ~35,000 oz gold production (fiscal year end is June 30th). For the last quarter ended Dec. 31, 2016 the Company had net income of $2 million, add another $3.289 million to that if you strip out Depreciation & Depletion write-off -- demonstrating strong positive cash flow. That income, in the last quarter, was generated off gold production of 9,764 ounces, gold sales of 10,430 ounces, and revenue of $15.9 million from gold sales. Cash costs averaged $889 per ounce ($667/oz USD), with all-in costs of $1,208 per ounce ($905/oz USD). Gold sales during the quarter were sold at an average price of $1,522 per ounce ($1,141/oz USD).

Graph 1 (above) - MTO per quarter gold ounces sold and cash cost - note cash cost are dropping.

Near-term Growth plan; two sources of ore + larger capacity. The Barry open pit is nearly ready to reopen (targeting Barry production entering 2018), the PEA has a payback of only 0.71 years (based on a gold price of $1,560/oz), and has an IRR before taxes of 198%. The next year will provide Metanor an excellent opportunity to expand capacity at the mill to accommodate more ore from both fronts. Increase mill capacity: Metanor's mill currently operates at 800 TPD capacity when processing Bachelor ore, and 1,200 TPD when processing softer Barry ore. The mill capacity can be expanded to 2,000 TPD in short order with a nominal capital cost of ~$7 million Canadian.

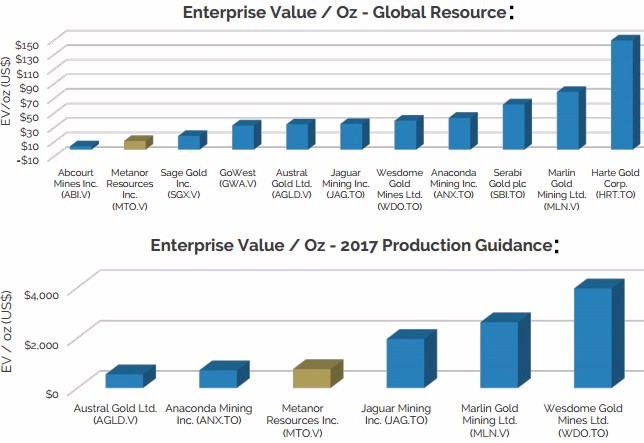

Comparatively 'as-is', ignoring plans, MTO's Enterprise Value/Gold oz, both in the ground and produced, shows the company trading at a compelling valuation that supports share price accumulation:

Additionally, Metanor also benefits operationally from foreign exchange, receiving a large $/oz price differential for gold in Canadian dollars over US dollars.

The Bachelor Mine Property:

Fig. 2. (below) - Claims map of Bachelor Mine. The longitudinal section facing north identified as Section A - A is enlarged further down in Figure 4 and covers the underground mine sections of the Hewfran and Bachelor claim blocks of the Bachelor Mine. Click the thumbnail video to open a 2 min. 50 sec. tour of Metanor's Bachelor Mill and property.

Full copy of the Mining MarketWatch Journal Review may be viewed at http://miningmarketwatch.net/mto.htm online.

This release may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

SOURCE: Sector Newswire editorial

Additional Disclaimer and Disclosure I Contact I Terms and Conditions I Copyright I Privacy Policy |