|

Sector

NewswireTM

Sector: Mining - Metals and Minerals

Sub Sector: Precious Metals

News Release -

August 28,

2009 4:34 PM EST

Mining Sector: Orex Exploration

High-Grade Deposit to Grow Substantially with Validation of New

Model Which Include Large Structural Domains of Gold

Orex Exploration Inc.'s (TSX-V: OX) high-grade

800,000oz gold deposit at their 100% owned Goldboro Property in Nova

Scotia, Canada is expected to substantially increase upon validation

of their new resource model which include large structural domains

of gold. The risk-reward characteristics are highly advantageous for

investors establishing a long position in OX.V as a much higher

revised resource estimate is expected. Considering the impressive

nature of its Goldboro project OX.V appears undervalued with only

~120M shares outstanding and trading under CDN$0.15, an estimated

~150M shares should be outstanding upon completion of financing

necessary for the Orex to complete all necessary work up to and

including a final resource estimate (215M shares fully diluted).

Orex is already at a NI 43-101 compliant ~800,000 oz gold resource

now and has the infrastructure in place to take material away to be

processed at nearby mills which they are actively in discussion with.

NEW YORK, NY --

August 28, 2009 /Sector Newswire/ -

Mining MarketWatch Journal has published a

review on Orex Exploration

Inc. (TSX VENTURE:

OX) (Frankfurt: O5D).

The review offers insight and opportunity afforded investors as the

current ~800,000oz gold resource is set to take a large increase in

size upon validation of new resource model. The current 2009

resource estimate (now at 397,200 gold ounces measured & indicated,

405,926 gold ounces inferred) at Goldboro is based on developing a

highly economical deposit and uses a high-grade cut-off. Orex's

management believed data that will follow upcoming drilling and bulk

sampling should allow this improved model to define a very large

high-grade deposit. Goldboro is a significant past producer, having

produced between 4.6 - 6.6g/t, which is also the same grade

(4.56g/t) Orex proved in recent 2009 resource estimate while in

transition to a new model. The new model moves focus to more

economic parts of the property and has higher grade cut-off,

employing structural domains of gold that quantify gold in zones

around and between slates and incorporates the nugget effect native

to Goldboro. The last resource estimate had to attribute 0 values

for these high-grade zones under 43-101 regulations until assay data

confirms what geologists have identified and understand to be there.

New drilling, infill drilling, and bulk sampling aims to validate

the new model and provide a large increase in gold resource

estimate.

The full review and valuation

commentary may be found at:

www.MiningMarketWatch.net/OX.htm

|

Visible Gold: The

property is characterized by the 'nugget effect' -- little

flakes of gold, specs of gold, nuggets of gold, all

throughout the property. Phase C drilling results revealed

numerous instances of visible gold. Examples above are from

previous drilling at Goldboro, some samples were as big as a

fingernail. Orex has a much better definition of the grade

now as they are employing not only fire assays but also

protocols and metallic screen assays which incorporate the

nugget effect native to Goldboro. |

Orex's new geological model is

a refinement of the Australian Goldfields Model for New

Bendigo / Ballarat deposits which have production, reserves

and resources of 30,000,000 oz and possess similar

characteristics to Goldboro - the model takes into account

gold mineralization factors of extreme gold nugget effect,

irregular gold distribution and the others issues unique to

Goldboro. The Bendigo / Ballarat systems also employ models

that capture domains of gold such as new model that Orex

believes it has finally got a handle on for Goldboro.

This August Orex released a

43-101 resource report at the 60% mark of their planned

drilling (Orex has completed 12,000m out of an original

20,000m planned). The report was originally commissioned and

designed to be stepping stone, providing a snapshot in order

to determine how to best proceed. In the process of

analyzing the data Orex decided to take a different tact,

one they believe will be more beneficial for the company

down the road. It was recommended and agreed that Orex

changed focus from a high tonnage resource model to a new

model that focuses on more economic parts of property with a

higher grade cut-off and a new model that employs structural

high-grade domains of gold that quantifies gold in zones

around and between slates.

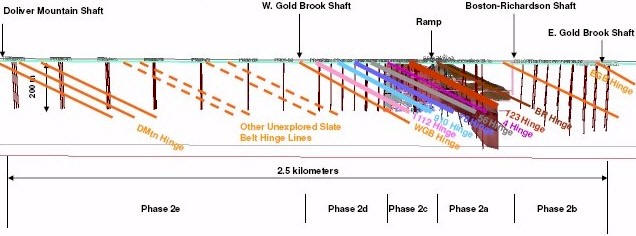

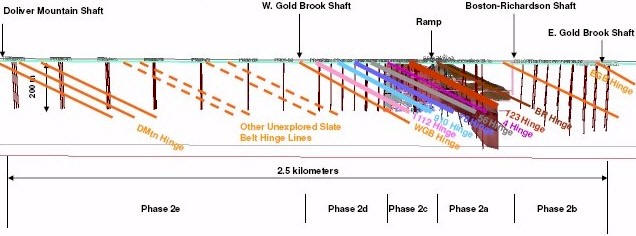

Looking Forward - There are two things Orex will be doing in the next

coming months:

1) Drill to put the entire

property in a 43-101 context

The numbers from the last report are for a 1.5km strike primarily on the

eastern part of the property and that includes the ramp eastward to East

Goldbrook. Orex will now drill out on the western part of the property

on what’s called Doliver Mountain and West Goldbrook. Orex knows there

are four high-grade zones there that replicate some of the zones they’ve

intercepted on the eastern part of the property and it is Orex’s

intention to drill that as well as some other areas and to put all that

into a 43-101 context. Right now Orex has a portion of the property in

43-101 context, with the next report out they’ll have the entire

property in a 43-101 context and Orex expects to have a significant

amount of ounces added based on additional drilling.

2) Validate their model

that captures domains of gold

When Orex looked at modeling the deposit they looked at the traditional

slate belt modeling which looks at various zones; they are thin zones of

high-grade gold and then you’ve got grey-wacky or sandstone, you might

get a little bit of gold in that and then another belt of high-grade

gold and so on. Orex looked at what the Australians do and they have in

the Bendigo-Ballarat systems, in the state of Victoria, very similar

deposits to this and they have models that capture domains of gold. So

instead of just looking at individual slate belts (Orex has ~20 slate

belts in 43-101 context right now), what Orex realizes now is that they

have ‘zones of gold’ at Goldboro. If you add up four or five belts, even

in between the belts you have gold mineralization, in many cases there

could be something like 1g/t which is significant when you should expect

nothing. So Orex did a different model of the deposit looking at these

‘domains like’ instead of just ‘individual slate belts with nothing in

between them’. In looking at various domains Orex picked out four

domains adding slate belts across the property, with validation these

domains of gold will dramatically increase the amount of gold Orex can

quantify. Orex requires better

sampling from these zones to produce a compliant report as there are

certain zones that historically were not sampled, because back in the

80s and 90s they didn’t know that these various zones existed so they

sampled different parts of the core and didn’t sample the parts that

Orex needs today to put that domain model into proper context. So

unfortunately for many parts of these domains Orex was forced to give

areas where they believe quite strongly that there is gold

mineralization a 0 g/t value (because the independent firm signing off

on it is required to assume it is 0). The geologists understand there

is gold there, they just don’t know how much. From what is now

understood from analyzing the last round of data is that the geologists agree

with the new model, but are required to validate that model in all

areas. Orex has to do some more drilling in those areas to establish

'proof positive' of gold -- the significance of this validation can not

be understated, we asked people at Market Equities Research Group whom

are familiar with the Bendigo-Ballarat systems in Australia what

'validation' means for Orex "when it comes to

unleashing the potential of the model that quantifies these domains of

gold 'validation' changes the picture quite dramatically from a numbers

perspective and from looking at the deposit from not just as a series of

little belts but as big areas of mineralized gold deposits -- that’s

what Orex is going to try to prove in this current (new) part of the drilling

campaign -- they are going to do two things; they're going to do

an additional kilometer to the west and they are going to do some of this

infill drilling to prove out their new model and when they come back to the

market with another final 43-101 it will not have just the entire

strength length but it will have all of that within the context of this

large structural domain model.”...

|

Figure 18. 3D

Goldboro Longitudinal View (Facing North)

Showing 2008 DDH Program & Slate

Belt Mineralized Zone Hinge Lines. |

|

The full review and valuation

commentary may be found at:

www.MiningMarketWatch.net/OX.htm

This release may

contain forward-looking statements regarding future events that

involve risk and uncertainties. Readers are cautioned that these

forward-looking statements are only predictions and may differ

materially from actual events or results. Articles, excerpts,

commentary and reviews herein are for information purposes and are

not solicitations to buy or sell and of the securities mentioned.

Readers are referred to the terms of use, disclaimer and disclosure

located at the above referenced URLs.

SOURCE: Sector

Newswire per: Mining MarketWatch Journal

editorial@SectorNewswire.com

Additional Disclaimer and Disclosure I

Contact I

Terms and Conditions I

Copyright I

Privacy Policy

|