|

Sector

NewswireTM

Sector: Mining - Metals and Minerals

:

News Release - February

19, 2016 4:36 PM ET

New Carolin Gold Corp. Approved to Acquire 100% of Ladner

Gold Project from Receiver for Century Mining Corporation (Past

Owner)

NEW

YORK, NY, February 19, 2016 /Sector Newswire/ -

New Carolin Gold Corp. (TSX-V: LAD) (OTC: MDULF)

announced news this last week that it has received approval from

Quebec Superior Court of its arrangements to

acquire 100% of the Ladner Gold Project. The Ladner Gold Project is

located only 150 km East of Vancouver, BC, Canada, in the Coquihalla

Gold Belt. New Carolin's Ladner Gold Project hosts 5 past producing mines and a high-grade

underground historic (non 43-101) resource at the Carolin Mine of

728,429 gold ounces (affirmed by Century Mining's 2009 estimate of

potential quantity: 5+ million tonnes grading 4.2 - 4.8 g/t gold, or

~1 million tonnes grading 8 - 9 g/t gold) -- the Company currently

has an inferred resource on the property in excess of 600,000 ounces

(although lower grade until confirmation drilling is performed) that

it is in the process of improving upon. LAD.V is advancing with

plans to bring this historic gold resource compliant, and also

prove-up the larger multi-million oz high-grade mesothermal Bralorn/Motherlode-type

model potential.

LAD.V's current market capitalization is ~$8 million (~88.7M

shares outstanding X ~9 cents (~123M fully diluted, we estimate

there will be 164,761,213 shares outstanding fully diluted after the

current private placement to close off 100% acquisition is

completed)). Bringing the 2009 estimate of potential quantity into

resource will give LAD.V immediate intrinsic value worth several

times the current market cap. Shares of LAD.V are poised for upside

revaluation as the inherent value and accomplishments are

appreciated by the market, and apt to respond in multiples as gold

retrenches and strengthens.

The Ladner Gold project

is a highly coveted asset, and due to its desirability the property

was essentially in abeyance for several years; despite LAD.V

originally only having 10% ownership (now 40%), LAD.V was the

controlling operator and owned 100% of the salient pieces that made

the property functional to LAD.V alone (mine permit, environmental

bond, roads, water licenses, etc.), the receiver for Century Mining

(60%) and related Tamerlane (30%) held the balance. New Carolin Gold

Corp. is at an improved level of relationship with the receiver for

Century Mining, whom we believe is Deutsche Bank. The improved

relationship will see LAD.V increase its ownership of the Ladner

Gold Project to 100% and enable LAD.V to facilitate the exploration

and development of the Ladner Gold Project. The receiver has

acquiesced and the relationship is cooperative; the transfer of

Tamerlane's interest to LAD.V in September-2015 marks a turn in the

relationship -- LAD.V now owns 40% and the February 3, 2016 news

release confirms there is an agreement in place whereby LAD.V only

needs to provide a nominal amount to Deutsche Bank in return for the

remaining 60%, additionally Deutsche Bank has agreed to allow that

money be applied towards exploration in exchange for 20,000,000

shares (at which time it will become the largest shareholder of

LAD.V -- LAD.V has already advanced a block of shares as part of

this payment). The February 17, 2016 new release confirms the

court has approved the arrangement to proceed. A nominal capex of $1M appears sufficient for LAD.V

to push the project into 1 million - 1.5 million ounces gold with a

mineable grade, this high-impact/low-cost program is facilitated by

the high standard of historical drilling and associated database

(700+ holes, ~50,000 m). There is also potential to prove up a new

major gold zone adjacent the Carolin Mine in the process.

Recent

(February 17, 2016) news from New Carolin Gold Corp.:

|

Approval of

Amendments to Acquisition Agreement – Ladner Gold Project

TheNewswire / February 17, 2016 - New Carolin

Gold Corp. (the “Company” or “New Carolin”) (TSXV: LAD)

announces that further to Company’s press release of

February 3, 2016, regarding the acquisition of the remaining

assets held by the receiver of Century Mining Corp, that the

hearing was held February 10, 2016 and the Quebec Superior

Court has since granted the order approving the amendments

to the acquisition agreement entered into with the Receiver

of the assets of Century Mining Corp.

The granting of this order is the final leg in respect to

allowing the Company and the receiver of Century Mining

Corp. to facilitate the completion of the acquisition

process.

....click

here for full copy from source |

Recent

(February 3, 2016) news from New Carolin Gold Corp.:

|

New Carolin

Amends Agreement to Acquire 100% of Ladner Gold Project

TheNewswire / February 3, 2016 - New Carolin

Gold Corp. (the “Company” or “New Carolin”) (TSXV: LAD) is

pleased to announce that the Receiver of the assets of

Century Mining Corporation (“CMC”) has agreed, subject to

the authorization of the Superior Court of Quebec, to amend

the acquisition agreement (the “Agreement”) announced by the

Company on August 27, 2014 whereby the Company can purchase

the remaining ownership interests of CMC in the Ladner Gold

Project (the “Project”) in southwestern British Columbia. To

date the Company has acquired 40% of the Project with an

undivided 60% interest remaining with CMC.

The Receiver has now agreed that the amount of the financing

to be completed by the Company as a condition precedent to

the transaction will be reduced to $1,500,000, with $600,000

required to be spent on the exploration and development of

the Project. Of this reduced requirement, the Company has

raised $980,000 to date, leaving a balance of $520,000 to

meet this condition.

With respect to the funding requirement and to secure

additional exploration and working capital, the Company

announces a proposed offering of up to 23,000,000 units in

its capital stock for gross proceeds of up to $1,150,000

(the “Offering”) in a combination of flow-through units (“FT

Unit”) and non-flow-through units (“NFT Unit”). Both FT and

NFT Units are priced at $0.05, and will consist of one

common share and one common share purchase warrant

(“Warrant”). Each Warrant will have a two year term with an

exercise price in year one of $0.07 per share and year two

of $0.08 per share. Common shares delivered as part of the

FT Unit will be designated as flow-through shares (“FT

Share”) pursuant to the Income Tax Act (Canada). The

proceeds from the sale of FT Units will be used to fund

qualified CEE work on the Company’s exploration program at

the Project. Warrants issued, whether with FT or NFT Units,

will not have flow-through attributes nor be exercisable for

common shares with flow-through attributes. Proceeds from

the sale of NFT Units will be used for general working

capital. Finder’s fees may be paid in connection with the

Offering. All securities issued in connection with the

Offering will be subject to a four-month plus one day hold

period from the closing of the Offering.

The original terms of the Agreement provided that the shares

issuable to the Receiver, as consideration for the property

interest being acquired, be limited to up to 20,000,000

shares. As consideration for the Receiver’s agreement to

amend the terms of the Agreement and accelerate closing, the

Company has agreed that the shares issuable to the Receiver

will be, immediately after issue of same (including the

common shares issued under the Financing or in connection

with any other conditions to the transaction outlined in the

Agreement), together with all other shares of the Company

then held by the Receiver, equal to 19.9% of the common

shares of the Company then issued and outstanding.

The Receiver has further agreed to reduce to $400,000 the

Company’s accounts payable and accrued liabilities which it

is required to settle as a condition precedent to the

closing of the transaction. In this regard, the Company has

recently settled over $400,000 in debt.

In addition, the Company has also agreed with the Receiver,

as a condition of closing, to obtain an agreement from one

of the Company’s creditors to amend the terms of a recent

secured loan for $200,000, so that such loan shall not come

due and payable until December 31, 2016. The Company has

secured this agreement.

Other closing conditions include receiving TSX Venture

Exchange approval, in addition to obtaining an order from

the Superior Court of Quebec authorizing such amendments.

The Company has spent the past 3½ years working to complete

this acquisition and looks to re-energize its activities

after having overcome many hurdles and poor market

conditions. Upon acquiring the remaining interests of the

Project, the Company believes the investment community

following it will finally be able to measure and attribute

value in keeping with the Company’s assets. The Company

looks forward to concluding the acquisition process and

executing its plans at the Ladner Gold Project.

About New Carolin Gold Corp.

New Carolin Gold is a Canadian-based junior company focused

on the exploration, evaluation and development of 144 sq.

kms of contiguous mineral claims, collectively known as the

Ladner Gold Project. The Project is located near Hope, BC,

in the prospective and under-explored Coquihalla Gold Belt,

which is host to several historic small gold producers

including the Carolin Mine, Emancipation Mine, Pipestem Mine

and numerous gold prospects. For additional information,

please visit the Company’s website at www.newcarolingold.com

....click

here for full copy from source |

Past

production, development, and exploration on the Ladner Gold Project

The property has been producing gold since 1890, there are numerous

high-grade artisan workings along the fault line that runs the

length of the 28 km-long property, mostly they were chasing very

high-grade surface showings, some up to 120 - 130 oz/tonne.

Meaningful exploration and development of the property started in

1975 with a mining company that drilled out the Carolin Ladner Gold

Project and put it into production in 1982 -- unfortunately gold

prices were uncooperative; when they drilled they were at

near-$800/oz gold and when they got the mine into production gold

was at $400/oz and heading the wrong way. The project had terrific

headgrades (near-5 g/T) but the operators were deficient in their

mill set-up and operating skills, attaining only near-30% recoveries

for the first ~3/4 of their operation before upgrades yielding ~60%

recoveries -- this has serendipitously set-up an opportunity for the

current owners of the property as the tailings are richly-laden in

gold and readily exploitable. Athabaska Gold explored and developed

underground in the mid-90's with the intent of blocking-out a solid

mineable grade and released a resource estimate in 1997:

|

Resources |

Tonnes |

Grade g/T |

Ounces |

|

Measured: |

1,124,040 |

4.31 |

155,775 |

|

Indicated: |

1,393,460 |

4.28 |

191,768 |

|

Total M&

Indicated: |

2,517,500 |

4.29 |

347,543 |

|

Inferred: |

2,569,540 |

4.61 |

380,886 |

|

Total/All

Categories: |

|

|

728,429 |

* This

resource estimate pre-dates NI43-101 standards

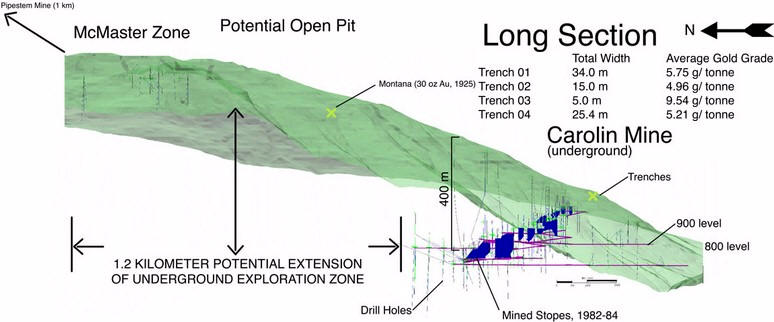

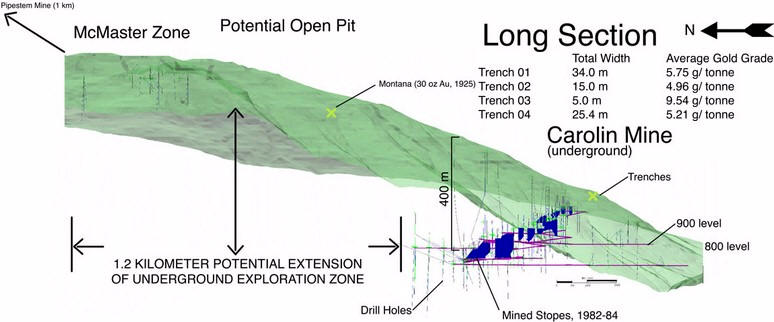

Figure 1 (right) - Carolin

Mine model derived from current drill hole

database; the blue represents mined out

areas and the red represents gold assays of

minimum 1.0 g/t and higher.

|

|

|

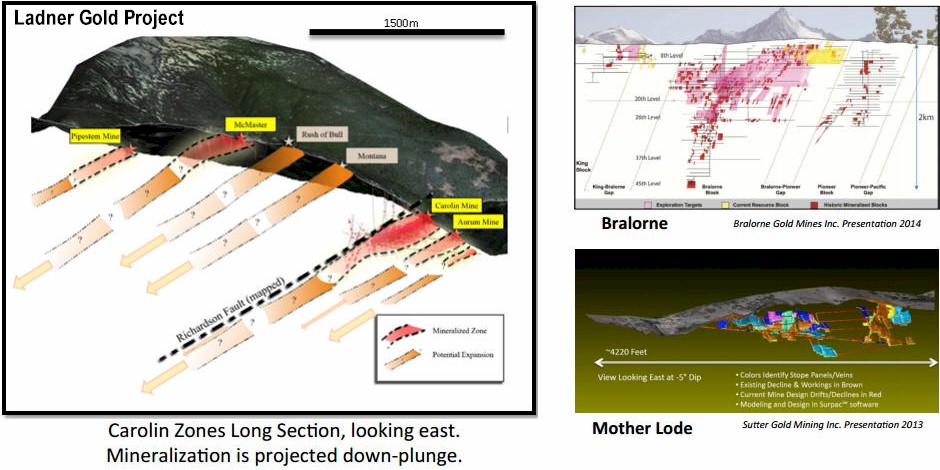

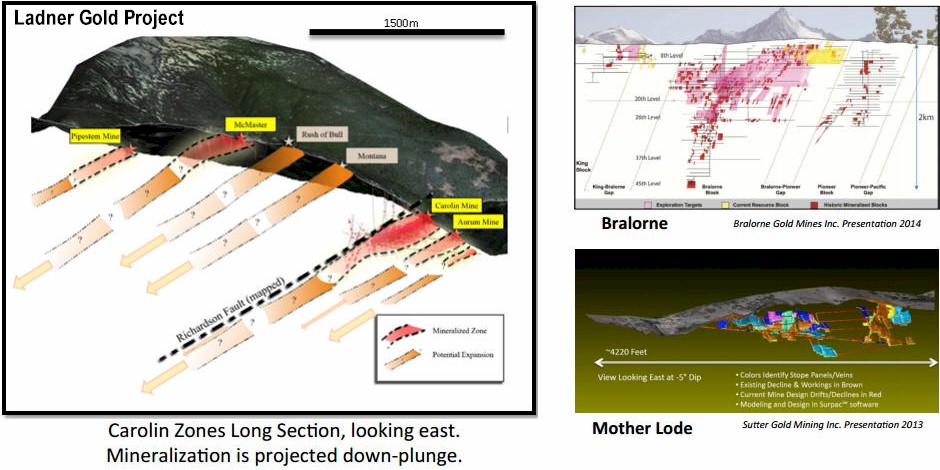

Figure 3.

Mineralization/Geological Model

- 5 Historical Mines & 30 known gold showings along

fault.

|

Athabaska Gold spent ~$3.5 million proving up

new ounces and defining high-grade areas they could mine, but by the

time they were looking to raise money to put the Carolin back into

production gold was down in the $300 range heading toward $250.

Tamerlane and its sister company Century Mining picked-up the

property to take the Carolin Mine to production but it got

financially spread thin and bogged down elsewhere. LAD.V stepped in

late in the game just prior to the receiver getting involved and got

its foot in the door.

Figure 2. (above)

large potential resource growth between McMaster and Carolin Mine

Ability to add significant ounces: The

Carolin Mine mineralized zone is open in all directions, the

underground workings are dry, and fully accessible. A mine

development map from 1981 shows level 800 being extended north for

1.2 km to the McMaster Zone, this was never performed, however

this area between is highly prospective for additional ounces. Most of the drilling to date on the project has been to

expand existing mining that originated from surface showings

(chasing the known mineralized structure), the project has received

next to nothing (only been drilled sporadically & nominally) for exploration and remains largely untested even in obvious

areas where confidence is high something major geologically has

occurred. The McMaster zone has a heavily discounted current

resource of ~79,540 oz with over half the existing resource at ~2+ g/t and near

surface, but the bigger story is in what the confirmation drilling

on Carolin & McMaster and other new targets will yield; it is theorized the McMaster has the

potential to rival and surpass the historical Carolin figures in

size and grades. All drill holes on the project to date have been

relatively short (nothing more than ~200 m) and all have intersected

gold.

The geological model

and local structures at Ladner Creek are comparable to Bralorne (4M

oz) & Motherlode (7 million oz producer) mining camps:

The Hozameen fault runs along the length of

the Ladner Gold Project: All the mineralized gold zones on New Carolin's

Ladner Gold Project appear to be like streams coming from the fault

to surface; 30 degree-angled

down-dipping stacked zones. High

priority target areas LAD.V has identified are expected to affirm

Ladner Gold Project has similar geological makeup to a high-grade

shale-based mesothermal Bralorn/Motherlode-type model. The theory is

there is a brand new zone running between 1.5 - 3 km that needs to be drilled.

Confirming a new major gold zone will demonstrate multi-million

ounce large-scale exploration potential of the model -- if so, there

could be potential for 10 - 20 million ounces on the property.

Recoveries of up to 94.5% possible:

Metallurgical test work of core taken from the McMaster Zone (DDH

32-09; 3.96 g/t gold over 27.6 m from 32.4 to 60.0 meters) indicates

overall gold recoveries of up to 94.5% possible. Pressure-oxidation

and carbon-in-leach has shown recoveries of 96.3% on floatation

concentrate. Using floatation, pressure oxidation and cyanidation of

the floatation tailings returned overall recoveries of 94.5%.

Tailings resource to be sold/leveraged:

|

Figure 5.

Carolin Mine in

production, 1984 |

Figure 6.

Tailings impoundment facility,

drain ~12 feet off and

you could drive a truck onto it. |

Figure 7.

Gold-laden tailings sample |

|

The tailings impoundment host a homogenous

resource that is readily accessible and is actively being marketed

for sale to generate capital so Company may advance the Ladner Gold

Project without share dilution. 69 holes were drilled into 60% of

the tailings establishing a resource of 404,000 tonnes Indicated

grading 1.83 g/t (~24,000 contained oz gold) and 84,400 tonnes

Inferred grading 1.85 g/t (~5,000 oz gold). Naturally we can

logically deduce there is probably ~40,000 ounces since only 60% was

drilled. Also we note historical production records show the mine

put through ~85,000 ounces of gold material yet only ever sold ~44,000, so

that leaves 41,000. LAD.V has several options, however the preferred

is to sell the tailings outright to a the 3rd party that will

process it, at current gold prices we estimate this should net in excess of $10 million (after capex & opex) over a 4 year

timeframe -- a discounted sale price now has the potential to

generate between $2 - $3 million to New Carolin Gold Corp.

|

Figure

8.

Gold bar from past production

at Carolin Mine, close to half the gold

contained in material processed at the time

still remains in the tailings awaiting

reprocessing. |

Sector Newswire has

identified the following research links for additional DD on New

Carolin Gold Corp.:

This release may

contain forward-looking statements regarding future events that

involve risk and uncertainties. Readers are cautioned that these

forward-looking statements are only predictions and may differ

materially from actual events or results. Articles, excerpts,

commentary and reviews herein are for information purposes and are

not solicitations to buy or sell any of the securities mentioned.

SOURCE: Sector Newswire editorial

editorial@SectorNewswire.com

* The current

Carolin Mine Inferred Mineral Resource is reported, at a 2.0 gpt

gold cutoff grade, as 2,589,000 tonnes grading 3.34 gpt gold

(estimating a total gold resource of 278,000 oz). A second Inferred

Mineral Resource was estimated as well, at a 0.5 gpt gold cut-off

grade, to reflect open pit mining potential. This estimate was

12,132,000 tonnes grading 1.53 gpt gold and containing a total gold

resource of 607,000 oz.

The current McMaster Zone Inferred Mineral Resource is reported at a

0.5 gpt gold cut-off grade to acknowledge itʼs open pit potential.

This estimate was 3,575,000 tonnes grading 0.69 gpt gold and

containing a total gold resource of 79,540 oz.

The current Tailings deposit Indicated Mineral Resource estimate is

reported, at a 1.0 gpt gold cut-off, as 445,000 tons grading 0.053

oz/ton gold and containing 24,000 oz. gold. The current Inferred

Mineral Resource for this deposit, at the same 1.0 gpt gold cut-off,

is 93,000 tons grading 0.053 oz/ton and containing 5,000 oz. gold.

Any reference to

recourses that are "historic (non 43-101)" and any references to

"estimate of potential quantity" are not to be relied upon for

investment purposes; the Historic (non-43-101) Athabasca Gold

resource was 1,124,040 t at 4.31 g/T Measured, 1,393,460 t at 4.28

g/T Indicated, 2,569,540 t at 4.61 g/T Inferred. The Century Mining

2009 estimate of potential quantity is referenced from a May-2015

Technical Report filed on SEDAR.

Additional Disclaimer and Disclosure I

Contact I

Terms and Conditions I

Copyright I

Privacy Policy

|